FAQ's

Please download the document for the information regarding detailed process of Investment Switching.

What is a pension and why contribute

The State Retirement Pension is a fixed benefit (it is not salary related) and it is insufficient on its own to provide for you in your retirement. You should aim to top up the State Benefit with a Revenue Approved Plan. Such a plan provides you with a very tax efficient mechanism to fund for such Retirement Benefits e.g. Employer Contribution to your Retirement Savings Account, no Benefit-in-Kind assessment on the Employer Contribution, Income Tax relief on your own Member Contribution, tax free investment returns on the Pension Fund and a Tax Free Lump Sum at your retirement.

The Plan might also provide day-to-day protection for you and your Dependants in the event of your death whilst an employee of the Company. These benefits should add considerably to your own security and that of your Dependants.

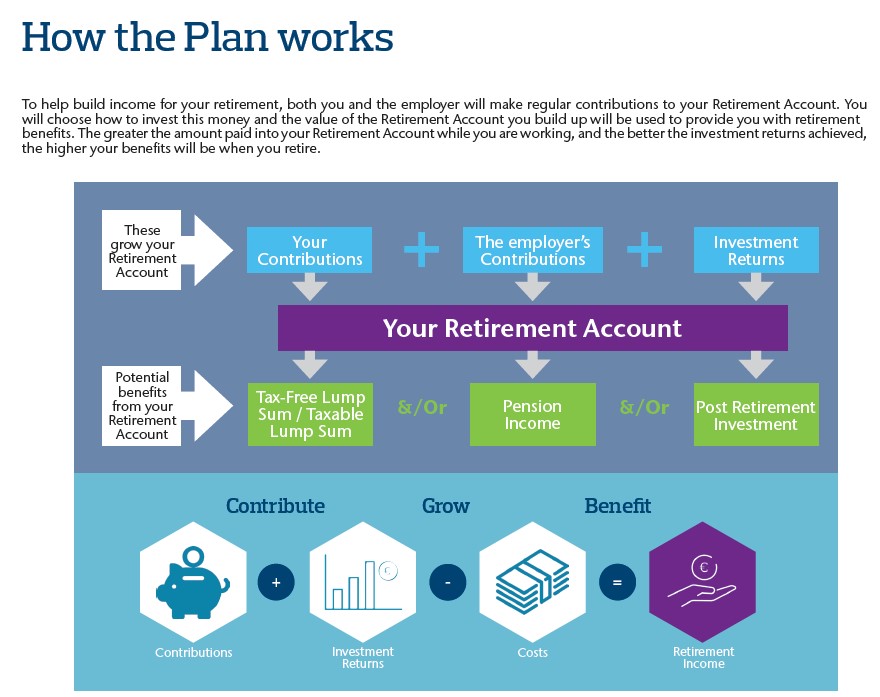

In this instance, money is usually paid into the plan by both an individual and their employer. At the point of retirement, the pot of money an individual has built up will be based on how much has been paid in, plus any growth on the money (less the costs of running the plan). Other benefits may also be provided under the plan. At retirement the pot may be paid out in various ways – for instance, as an ARF/AMRF, as a cash sum or as an Annuity.

It is essential to review your pension at least every year to ensure that it remains on track. Your pension is likely to be your main source of income in retirement and you may need it to last for 20 years or more. Retirement planning is all about deciding how much of today’s income you want to allocate to your life after you stop working.

Contributions and tax relief

This may not apply to everyone but, as a general rule of thumb, you could aim to contribute (between you and your employer) about half of your current age as a percentage of your income. In other words, if you are 30 years of age, you could aim for a total contribution of about 15% of your annual income between your contributions and your Employer’s. For someone earning €40,000, that is €500 per month in total between you and your Employer going into your retirement account.

It all depends on what age you started making provision for your pension, and what other pension arrangements you may have. Check out our modelling tool here or, if you are already a member of an Aon plan, check out your planning tool customised for you on your plan website here www.aonfocus.ie

When you contribute to your retirement account under the plan, the real cost to you isn’t as high as you might initially think. A €100 employee contribution to the plan actually costs you €80 if you pay income tax at the standard rate of 20% and €60 if you pay income tax at the marginal rate of 40%. Income tax relief is normally given “at source” via payroll, and no tax or BIK is payable on employer contributions. There are age related limits of the relief that can be granted, but generally you can decide on how much you wish to contribute to the plan.

The table below shows the maximum percentage of your earnings from your employment that you can save into your pension and claim income tax relief on each year.

For a lump sum AVC, income tax relief can be claimed directly from the Revenue Commissioners in respect of the previous tax year. This can be paid after the end of that year as long as it is paid before 31 October of the current year (or later if you file your income tax return online), assuming it does not breach the income tax relief limits for the earlier year.

| Age attained

during tax year |

% of Taxable earnings

(capped at €115,000) |

Maximum contributions

if you have earnings of €115,000 or more

|

| Under age 30 | 15% | €17,250 |

| age 30 – 39 | 20% | €23,000 |

| age 40 – 49 | 25% | €28,750 |

| age 50 – 54 | 30% | €34,500 |

| age 55 – 59 | 35% | €40,250 |

| age 60 and over | 40% | €46,000 |

The maximum value of your benefits, across all your pension arrangements at retirement, cannot be more than the lifetime limit known as the Standard Fund Threshold (SFT), which is currently set at €2m, without incurring an additional tax charge for you.

If we have a process in place with your employer, you may be able to change your contribution rates directly on the website under My Contributions.

If you have an online benefit facility at work, then contribution changes will have to be made via that portal.

Otherwise, you will need to submit a form to your HR department. The form should be available under Knowledge Centre on the website.

Investments

You have the choice of investing in a fund or funds or your choosing from the range of investment funds available under the Plan, which are selected by the Trustees. The Trustees monitor the performance of the Investment Managers at regular intervals to ensure the funds perform in line with their benchmarks. Full details of the Investment Options available to you under the Plan are available from the Pension Plan website and in the Investment Guide.

The Trustees, and therefore Aon on behalf of the Trustees, cannot recommend where individual members should be invested. We would suggest that you adopt a long-term strategy having regard for your proximity to retirement. In general, younger members can afford to take a higher level of risk in an effort to provide a real long-term return, while members close to retirement should ensure that they are reducing their exposure to significant losses.

You can change your investment choice by submitting an investment switch on the pension plan website.

On the website you can access the investment fund fact sheets (under Knowledge Centre) and you can also see in graphical format the investment performance of the fund available to you (under My Investments).

Leaving service / cashing in

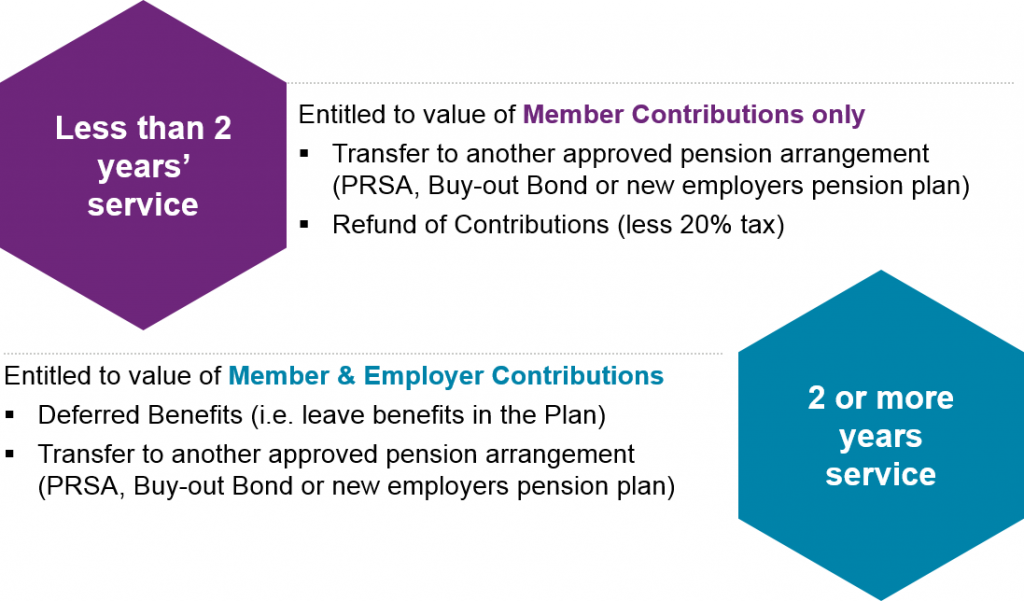

In general, if you have been in the pension plan for less than 2 years, you are only entitled to the value if your Member Contributions. If you were a member for over 2 years at the date of leaving the Company, you are entitled to the full value (i.e. Member & Employer Contributions).

This 2 year “Qualifying Service” is generally applied, however you should check your Member Explanatory Booklet to see if a shorter period applies.

It is also worth noting that if you transfer benefits in from a different Irish occupation pension plan, the service you had under that plan transfers also and counts towards the Qualifying Service:

If you have been in a pension plan for less than 2 years and you leave employment then you can request a refund of the value of any contributions you made to the plan, which would be subject to tax (currently 20%). However, in all other circumstances the funds cannot be cashed in until the member reaches an age where retirement is permitted by Revenue.

Change my personal details

Certain personal information such as Civil Status, salary and home address must be confirmed to us by your employer to ensure that we hold the same information.

Changes are notified to us by your employer periodically.

You should check with HR that they have the correct status recorded for you.

Retirement

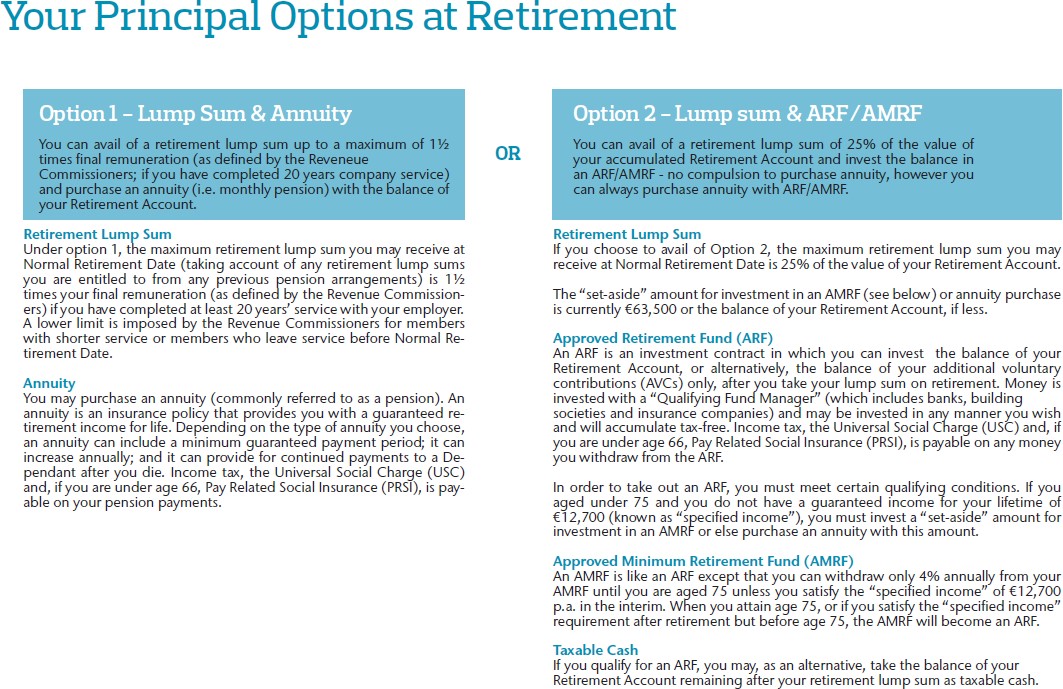

The benefits which you will receive from the Plan at your retirement will be based upon the accumulated value of your Retirement Account.

Most occupational pension plans have a Normal Retirement Date of age 65. There is provision for early retirement from age 50 onwards as permitted under Revenue Rules, however if you wish to take your benefits before your Normal Retirement Date you must have left the service of the company.

Your benefits at retirement will be based upon the accumulated value of your Retirement Account and will be based on the value at the date that you take your benefits.

Transfer In

In general, members can arrange to take a transfer in from another plan, but it does depend on the type of pension arrangement you have.

Should you wish to transfer in benefits you have from a pension arrangement, you should contact the provider of that pension arrangement to request the transfer. In order to complete the transfer, they will need certain information from Aon regarding the plan (e.g. confirmation you are a member, Revenue approval, etc.), and therefore you should provide them with Aon’s details as follows:

Address: Member Events Team, Aon, Hibernian House, Building 5200, Cork Airport Business Park, Cork, T12 FDN3

Email: MyFutureMe@aon.ie

Phone: 1850 80 42 57

Historically, an Irish plan could accept any transfer from a UK pension plan.

However, changes to UK legislation in 2015 governing overseas transfer from the UK might make your transfer problematic. UK law provides that transfers from UK plans can only be made to a Qualifying Recognised Overseas Pension Scheme (QROPS). It is now a condition of all UK plans and QROPS that the earliest retirement date is age 55 other than in cases of disability. As most Irish plans permit early retirement form age 50 as permitted by Revenue practice, they cannot qualify as a QROPS, thus a member bringing a transfer payment into an Irish occupational pension plan from the UK would incur a 55% personal tax charge levied by the UK Revenue Authority, HMRC.

Web access

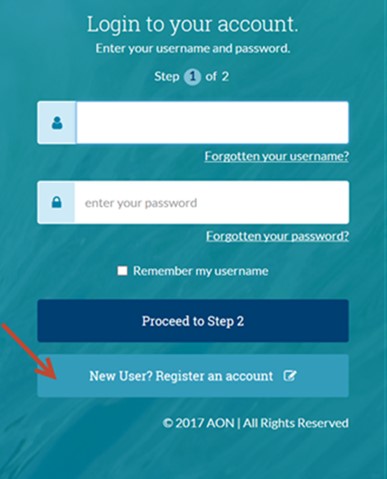

Aon launched a new pension plan website in 2018. All members are required to register for this new website. By completing this registration process, members will be able to create their own personal username and password, therefore any previous logins that were issued will no longer work.

Once registered, you will be able to see all information regarding your pension.

Your membership number is contained on any correspondence / benefit statements / e-mails you received from Aon regarding your plan membership. If you cannot locate it, please e-mail myfutureme@aon.ie

In order to begin the registration process please click here

Please note the following when creating your Username:

• Must be between 6 and 20 characters long

Once you reach Step 2 you will be required to answer 3 security questions. These answers must be at least 6 letters long with no numbers or special characters.

At this point a temporary password will be emailed to you. If you are copying and pasting this password from the email to the login screen can you ensure that no additional spaces are copied and only the password is copied over. If a blank space is copied over this will cause an error while trying to log in.

Once you receive your temporary password, on the homepage enter the Username you created during the registration process & your temporary password and click proceed to step 2. You will then be asked to enter certain characters from the answers of your security questions.

This will then direct you to create your own password.

Please note going forward you will use this password and your username to log in.

If you have any further queries, please do not hesitate to contact us.

Unfortunately, we cannot reset passwords and usernames anymore.

Best thing you could do is click ‘Forgotten Your Username?’ under the Username field and then follow those steps to retrieve your Username and similarly if you can’t remember your password click on ‘Forgotten Your Password?’, under the password field and this will let you create a new password and you should be able to log in then with this.